- Free Strategy Session: (847) 906-3460 Tap Here to Call Us

What Big Investment Mistakes Should You Avoid Right Now?

Many people are understandably concerned about their investments right now (spring 2020). News of the global pandemic is enough to cause the resolve of even the most steadfast investor to falter.

Why are Investors at Risk of Making Bad Investment Decisions?

We have never had a time where this kind of stress was affecting this number of individual investors. The Spanish Flu pandemic took place over a century ago – before the advent of IRA, Roth IRA, 401(k), 403(b) accounts – so a relative few people were making investment decisions. The more recent Great Recession, while affecting millions of individual investors, did not directly threaten the health and safety of individuals.

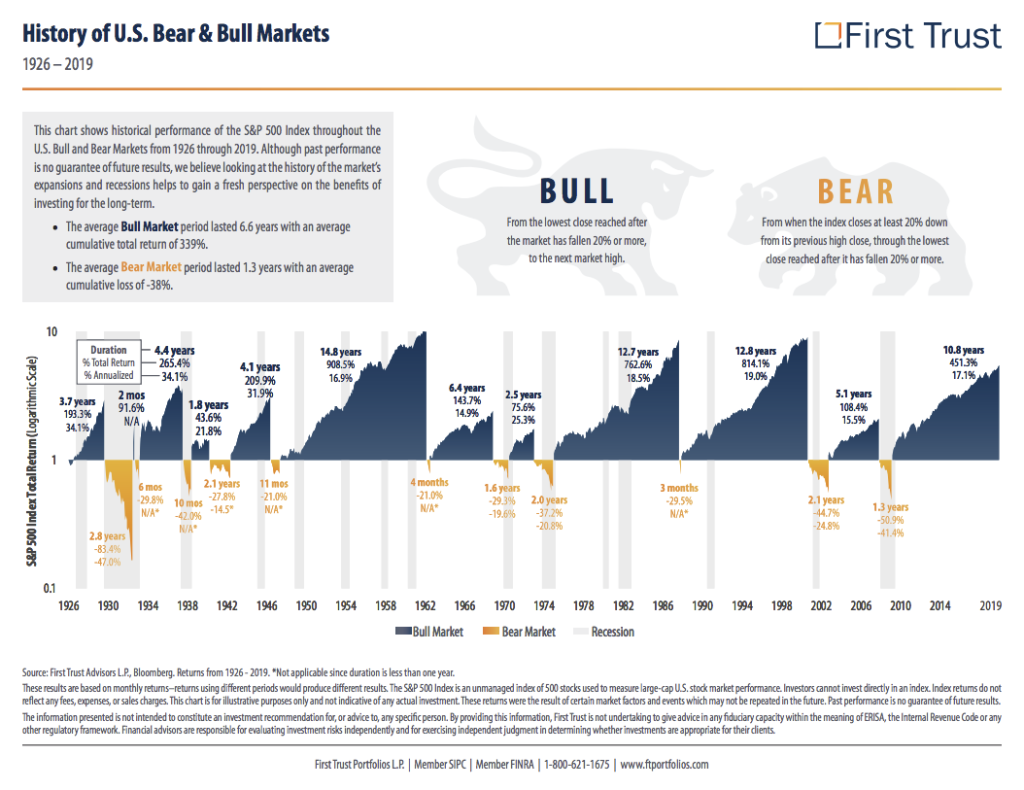

Stress makes all of us more likely to making bad decisions. Stress makes it more likely that we will succumb to behavioral biases that affect us all. For example, people are generally loss averse – we have losing a dollar more than making a dollar. So market downturns and volatility like we are experiencing can cause folks to cash out precipitously. People also tend to overweight recent events versus putting them in historical perspective. It is important to remember that markets go down as well as up. We have just experienced over ten years of a rising market. To put recent events in perspective, consider markets over the last century:

Many of those folks coming to you with investment suggestions are likely to be overconfident. It is hard for investment professionals to say “I don’t know.” It is hard for most people to say that. But that is what financial advisors should be saying – often. Beware folks who seem to have all the answers.

What that means right now is we, as investors, should be even more careful than usual. We should take our time before executing any investment decision. There will be folks out there claiming that they have a safe alternative for scared investors. Some of these folks will be hawking fraudulent investments. Some of these folks will genuinely, but wrongly, believe that what they are selling is safe.

Beware So-Called Safe Investments Like Fixed Indexed Annuities and Non-Traded REITs

There are two kinds of investment products that are likely to be misrepresented as “safe” investments that are not. They are fixed indexed annuities and non-traded REITs.

Fixed Indexed Annuities Lock Up Your Money for Many Years and Charge High Fees

What could be more comforting than the prospect of having a fixed income stream for life? That is the promise of annuities. Many of us already have some form of annuity – Social Security. Many of us pay Social Security taxes (like premiums) for many years and once we reach a certain age, we expect to collect a steady stream of income. Others are part of various pension plans for teachers, military personnel, federal and state employees, and sometimes employees of private entities. In those cases, you already have an annuity as part of your retirement portfolio.

I have written about the problems of fixed indexed annuities before. Since I wrote that piece, the sales of fixed indexed annuities have continued to skyrocket. Here is why those annuities are not the answer to our prayers.

Fixed indexed annuities are high fee products. You pay layer upon layer of fees to the insurance company that sell these products. Those fees are buried in the fine print that even the selling agent probably has not read. Moreover, all those nifty add-ons that you can get with the annuity are going to cost you. Those fees reduce your returns in ways that are not clearly disclosed in the hundreds of pages of documents you are given.

Fixed indexed annuities have long surrender periods. That means your money is locked up for a long period of time – like 7 to 20 years. You can get withdraw small amounts of money without paying surrender charges. But if you withdraw more, you have to pay surrender charges to the insurance company. Those surrender charges can be over 15%. That is a hefty fee to get your money in a pinch. Because these products pay big commissions to selling agents, the agents tend to emphasize the features (often including upfront bonuses) and downplay the risks (fees and index returns that fail to include dividends). Tara Siegel Bernard recently wrote an excellent article in the New York Times about fixed indexed annuities. You can access it here.

Finally, fixed indexed annuities are riskier than social security and other federal, state, and local pensions because they are issued by a company, not the government. While issuers are generally big stable insurance companies, even those insurance companies can become insolvent. Remember how AIG had to be bailed out by the federal government in the Great Recession? While state and municipal pensions might reduce benefits in the future, it is possible to lose all of your annuity investment if the issuer becomes insolvent.

Before you buy a fixed indexed annuity, consult with an independent advisor who understands these things. Some of those folks are identified in the Tara Siegel Bernard New York Times article mentioned above.

Non-traded REITs are Illiquid Investments With High Fees

Non-traded real estate investment trusts (REITs) are bad investments for many of the same reasons that fixed indexed annuities are bad investments. They charge high fees, some of which are used to pay high commissions to the financial advisors selling them. Non-traded REITs are not traded on any exchange so you cannot sell your shares if you need money. Non-traded REITs are also hard to value. Since the underlying real estate is not traded on an exchange, you have to rely on the REIT’s management to value those assets. There are long periods of time when markets may be volatile when it may wrongly appear that your non-traded REIT is stable. That is not the case. The fact that REIT management has not revalued the underlying assets does not mean that those assets are not worthless. You won’t see that until management sends out the next valuation.

Before you decide to invest in a fixed indexed annuity, a non-traded REIT, or a similar investment product, take the time to have it evaluated by an independent expert. While we routinely have a used car inspected by an independent mechanic and a house inspected by an independent expert before we buy, we do not do that with investments. That is a good way to avoid making a big investment mistake now and in the future.