- Free Strategy Session: (847) 906-3460 Tap Here to Call Us

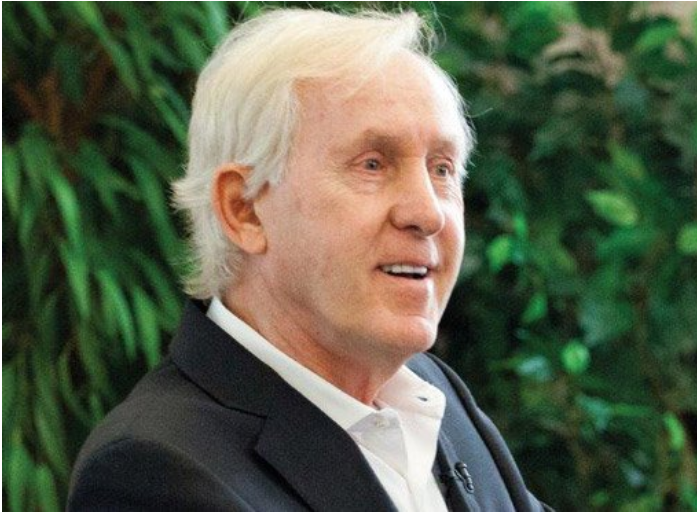

Equity Indexed Annuities – Fran Tarkenton Loves Them

Fran Tarkenton loves equity indexed annuities. That does not mean you should. Tarkenton is 79 years old and encouraging elders to purchase equity indexed annuities (also called fixed indexed annuities) as a way to protect themselves from elder financial abuse.

That’s right. Fran Tarkenton is encouraging elders to purchase these high fees, non-liquid insurance products instead of investing in low fee, highly liquid investments like broadly diversified stock and bond index funds. Tarkenton has even written a book touting equity indexed annuities as the answer to protecting seniors from financial abuse by family members.

Tarkenton has good reason to love equity indexed annuities — he sells them. They are good for him because they generate substantial commissions and fees for him. If you read this article, you will learn that Tarkenton owns some of these annuity products, but also lots of stocks.

While family members do engage in elder financial abuse, so do financial advisors and insurance salesmen. Selling unsuitable equity-indexed annuities to elders often is elder financial abuse because of their high fees and lack of liquidity. These annuities often have surrender periods of over 10 years. What happens when the elder investor needs money for medical expenses or long term care? The investor is out of luck – that’s what happens. Why do agents sell them to unsuspecting elders? Because the agent can earn an upfront commission from the insurance company of as much as 10%. A commission that is not disclosed to the purchaser.

Purchasers of equity indexed annuities are not protected by law the same way that purchasers of mutual funds, stocks, bonds, and even variable annuities are. That is because the powerful insurance industry convinced Congress that equity indexed annuities are insurance products — not securities — even when folks hawking them are obviously selling them as investments. If those annuities are not part of an overall investment plan, you might not be able to recover damages in FINRA arbitration.

I address the problems of annuities for retirees in another post that you can find here.

Getting back to Tarkenton, here is another reason he might prefer to sell annuities, rather than securities products. Twenty years ago, Tarkenton settled SEC charges of engaging in a fraudulent scheme to inflate his company’s earnings.

In its complaint, the SEC charged the following: “Tarkenton, Addington, Gossett, Fontaine, Hammersla, Alvarez, and Welch engaged in a fraudulent scheme to inflate KnowledgeWare’s financial results to meet sales and earnings projections. In all, KnowledgeWare reported at least $8 million in revenue from sham software sales. KnowledgeWare “parked” inventory with software resellers and other supposed customers that were given the right not to pay for the software, either orally or in “side letters” that were kept separate from the other sales documents. As a result of this scheme, KnowledgeWare falsely reported record sales revenue and dramatic increases in earnings in press releases and in quarterly reports filed with the Commission and disseminated to the public in 1993 and 1994 (“Quarterly Reports”).”

“Even when KnowledgeWare later restated those quarterly results, KnowledgeWare continued to mislead the investing public by claiming, in its annual report for Fiscal Year 1994 and other public documents, that the restatement resulted from a problem with the “collectibility” of reseller receivables — without disclosing that KnowledgeWare had created the problem by “selling” software and simultaneously granting the “purchaser” the right not to pay for it.”

“Tarkenton, Addington, and Gossett directed the fraudulent scheme and made materially false and misleading statements to purchasers of KnowledgeWare stock. Gossett also made materially false and misleading statements to KnowledgeWare’s auditors…. With the exception of Fontaine, each defendant received excess incentive compensation as a result of the scheme.”

According to the SEC, “Tarkenton consented to the issuance of a final judgment permanently enjoining him from (i) committing securities fraud in violation of Section 17(a) of the Securities Act of 1933 (“Securities Act”) or Section 10(b) of the Securities Exchange Act of 1934 (“Exchange Act”) and Rule 10b-5; (ii) falsifying corporate books and records or engaging in other conduct in violation of Section 13(b)(5) of the Exchange Act or Rule 13b2-1; and (iii) from engaging in conduct as a controlling person that would render him liable pursuant to Section 20(a) of the Exchange Act for violations of corporate reporting, recordkeeping and internal control provisions of the Exchange Act (Sections 13(a) and 13(b)(2) and Rules 12b-20, 13a-1 and 13a-13). Tarkenton also agreed to pay a civil money penalty of $100,000 and disgorge $54,187, the amount of the incentive compensation he received in Fiscal Year 1994 on the basis of KnowledgeWare’s materially overstated quarterly earnings, plus prejudgment interest thereon.”

Tarkenton might love equity indexed annuities more than securities because he could not get a license to sell securities.That’s just my opinion. I could be wrong. – Lisa Bragança