- Free Strategy Session: (847) 906-3460 Tap Here to Call Us

Chicago Attorney Calls to Eliminate Bias Credit Reporting

CHICAGO, Ill. — We are in the midst of a world-wide pandemic and millions are out of work. Yet, life goes on, bills need to be paid and credit reporting agencies are still keeping track of who is making their payments on time.

Most Americans are no doubt feeling the struggle but one Chicago-based investment attorney, Lisa Bragança, says many at the margins are getting kicked while they are down. It is only going to get harder for those struggling to make ends meet in 2020, in part because of biased credit scores.

“Bias in credit is one of those issues that generally fly under the radar because it is complicated and not transparent.” Bragança, a former Security and Exchange Commission Chief, explains. Bragança goes on to say “Also because its effects are primarily felt by lower-income families. According to the last United States Census, 38.1 million people are classified as living in poverty. Recently figures report 528,000 Chicago area people living in poverty. While it is hard for anyone to bounce back from economic setbacks, it is especially for low-income minorities. Biased credit scoring is one obstacle to their rising out of poverty.”

According to the last United States Census, 38.1 million people were considered to live in poverty. Today’s numbers show roughly 528 thousand of those people live in the Chicago area. Bragança points out, while most Americans can bounce back from economic hardship it’s harder for minorities. She says it’s especially tough for Black and Hispanic Americans with poor credit.

Long History of Bias Credit Reporting in the United States

“In the past, the government addressed overt bias in the credit scoring process. That stopped credit rating agencies from explicitly including race (and gender) as a factor in their calculations. It was a good start, but we know that did not eliminate all bias,” Bragança added.

The Fair Housing Act which prohibited redlining and discrimination against Blacks in employment, education, housing, and lending has only been around since the 1960s. Regulations were passed in 1968 to protect citizens from lenders basing their decision on race, sex, religion, age.

According to Bragança, racial discrimination by banks and lenders persists from cases that the U.S. Department of Justice brought against banks like JPMorgan Chase & Co (2017) and Wells Fargo & Co (2012). In those cases, DOJ laid out charges that in the first decade of the 21st Century African American and Hispanic homeowners were steered by these banks to higher-cost subprime mortgage loans while white homeowners with the same creditworthiness were not. These costly subprime mortgage loans end up in foreclosure far more often than ordinary mortgage loans – which negatively impacts borrower credit scores.

It’s been ten years since the Federal Reserve studied the credit reporting system. According to the 2010 study, the Federal Reserve published, there was not any evidence of a bias even though it had been receiving complaints for years.

“Our results provide little or no evidence that the credit characteristics used in credit history scoring models operate as proxies for race or ethnicity. The distributions of credit scores for different racial or ethnic groups or across genders are essentially unaffected by the re-estimation or redevelopment of the baseline credit scoring model in any of the race- or gender-neutral environments. This suggests that credit scores do not have a disparate impact across race, ethnicity, or gender.”

– Federal Reserve Board, Washington, D.C.

Investment Attorney, Bragança says the Fed study fails to account for African American and Hispanic individuals experiencing foreclosures, job losses, and other adverse events as a result of discrimination. When African Americans and Hispanics have been saddled with high-cost subprime loans, they are more likely to default, which negatively affects their credit scores. When credit scoring systems rely upon inputs that are biased, they generate an output that is biased.

Lower-income African American and Hispanic communities are particularly hurt by these biased credit scoring practices. Families may not be able to rent a home near their preferred jobs and schools because of their credit scores. Individuals may not be able to obtain an auto loan at a reasonable interest rate because of their credit scores – keeping them from accessing better jobs and education.

Not All Payment Types Considered

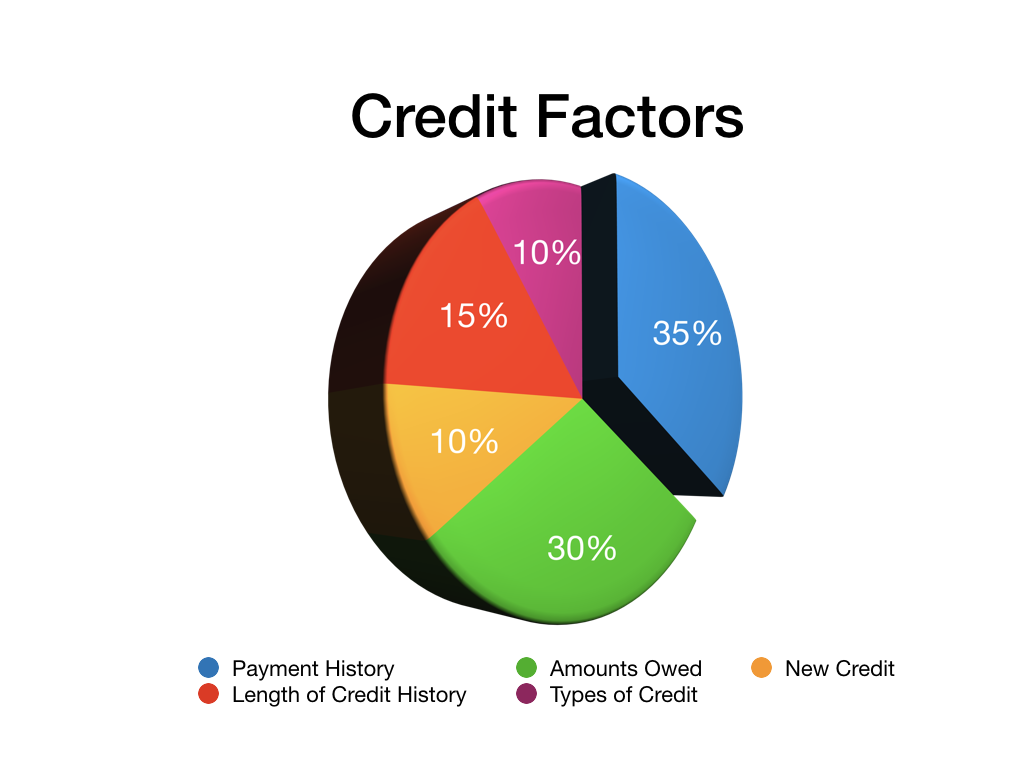

Credit reports weigh all types of information like amount owed, length of credit history, new credit, types of credit as well as payment history. Payment history is weighed the heaviest, making up 35 percent of the score.

“The fact that Black folks were excluded for most of the 20th century from homeownership means not only did they not accumulate wealth in the same way as their white counterparts, but they also did not have the opportunity to develop good credit history based on years of making mortgage payments. An African American family may have decades of on-time rent and utility payments, but those payments may not be weighed as heavily as mortgage payments.” Bragança explains.

Time and patience will undoubtedly be a factor moving forward. The most important thing is to be aware of the importance of a credit score. Step one is to request a free credit report from one of the three major credit reporting agencies. You can review the report to identify any erroneous information. If information is not accurate, contact the credit bureau to dispute the information.

Chicago Attorney Calls for Change

Credit reports, touted as neutral by private companies, are subject to ‘GIGO’ – garbage in garbage out. If the inputs are biased, the outcome will be biased. And this could only get worse as banks and lenders use even less transparent methods to make lending decisions, like artificial intelligence. The increased use by banks and lenders of artificial intelligence and other automated programs in determining lending practices are likely to be as biased as the current credit scoring system.

“What concerns me at the moment is the increased use by banks and other lenders of artificial intelligence and other automated program in determining lending practices. These programs may reinforce long-standing historical biases that disadvantage the Black community just like credit scoring.” Bragança said.

About Bragança Law LLC

Bragança Law was founded by Lisa Bragança, a graduate from the University of Chicago where she received a B.A. (with honors) and a J.D. / M.B.A. (Order of the Coif, honors). As a former Branch Chief in the Division of Enforcement of the Chicago Office of the Securities & Exchange Commission, she handled investigations of accounting fraud, Ponzi schemes, insider trading, churning, and unsuitable investments.

During her time at the SEC, Lisa collaborated with the DOJ in the investigation of subprime auto lender Mercury Finance Company. Three senior executives, including the Chairman/CEO, were sentenced to prison terms as a result of this investigation.

Lisa also collaborated with the DOJ on an investigation of Foreign Corrupt Practices Act violations arising out of the bribery of Haitian customers officials. The CEO and another senior executive were convicted and sentenced to substantial prison time due to this investigation.

Throughout her career, Lisa has been an advocate for the rights of people with physical, cognitive, and psychiatric disabilities. She previously served as counsel in three statewide class actions seeking to compel the State of Illinois to comply with the Americans with Disabilities Act. She also regularly speaks about elder financial exploitation, securities regulation, recovering investment losses, and cryptocurrency.